“A level playing field for Nextory CEO Shadi Bitar and BookBeat CEO Niclas Sandin to club one another’s brains out for the Storytel-vacated audio-streaming crown.”

Owned by hedgefund KKR, the US-based audiobook production outfit RBMedia made global headlines last year as it sold its Audiobooks.com platform to Sweden’s Storytel, and generally speaking RBMedia’s press releases can be guaranteed to be picked up by the English-language trade journals looking for filler items.

But not always.

This past few days Sweden-based BookBeat signed a deal with RBMedia to add 40,000 English-language titles to the BookBeat catalogue. But who’d know?

While the RBMedia acquisitions in France and the USA warranted a mention in the trade journals, RBMedia’s expansion of part of its English-language into BookBeat’s 28 notional marketplace is apparently not news.

To be sure, the acquisition of French audiobook publisher Éditions Thélème is a newsworthy move by RBMedia on the French-language audio market, even if it is focussed on recycled public-domain content.

As the UK’s The Bookseller notes, excerpting straight from the RBMedia press release,

The brand will join W F Howes, Wavesound, BookaVivo, and the recently launched German arm RBMedia Verlag as RBMedia’s international audiobook publishing businesses.

That is until KKR spins them off, as it did with Audiobooks.com.

Publishers Weekly managed to catch both the French and the US acquisitions – the latter being Upfront Books – and notes that RBMedia is fielding a total of 60,000 titles, again excerpting the RBMedia press release.

Per said press release, RBMedia claims to be the largest audiobook publisher in the world, and as previously reported had a “record-breaking 2021 performance”

Enter, stage left, BookBeat, now host to 40,000 English-language RBMedia titles.

BookBeat’s catalogue addition will be consumer-facing after the summer, as the BookBeat press release explains, and adds a substantial new raft of content to Bonnier-owned BookBeat as it prepares to compete with Nextory for the EU audiobook marketplace (Storytel’s ambitions being currently in limbo, per separate TNPS coverage).

Leaving aside the volume of the new deal, itself surely more than newsworthy, what is important in the BookBeat news is the statement from CEO Niclas Sandin that,

Not only are English titles demanded by our English-speaking users, but also by many of our users in our core markets.

This of course a sentiment expressed time and time again here at TNPS and why we so often cover print-retail outfit Big Bad Wolf, which specialises in taking English-language books – by the million – to countries where English is not the first language.

Publishers would do well to wake up and smell this particular blend of coffee. BookBeat and Big Bad Wolf are in non-competing sectors (audiobooks and print) and non-competing markets (Big Bad Wolf focussed on APAC, BookBeat on the EU) but the message is the same.

There is lucrative demand for English-language books if publishers will only step outside the comfort zone of territorial restrictions that evolved in a bygone era and would make their titles available globally.

But let me end this post with the focus again on BookBeat. As I’ve noted many times here at TNPS, the global audiobook market beyond the usual suspect safe-bet nations, has long been a competition between Storytel, Nextory and BookBeat.

For the longest while it seemed Storytel was unbeatable. Then the shareholders took control of the company, ousted CEO Jonas Tellander, tied Acting CEO Ingrid Bojner’s hands, and now Storytel’s future as a serious global player hangs in the balance.

Nextory, it had seemed, was the player to take Storytel’s crown, and that still may be the case. But I am heartened by what may just be a throwaway line but I hope has substance, hidden away in the BookBeat press release on the RBMedia deal.

Niclas Sandin, noting BookBeat has already this year launched in Norway, the Netherlands and Belgium, adds:

The ambition for expansion in upcoming years is extensive.

Which suggests this year’s new launches have been exhausted, true, but that unlike at the now lame-duck Storytel there is still ambition at BookBeat.

Sandin further observes, making my earlier point about the value of English-language content:

Offering a high-quality catalogue of English titles will be a very important factor to continue the growth in the existing markets, and when launching in new ones. During the fall BookBeat will continue to contract international publishers to increase its selection of English titles.

The big unanswered question is where that “extensive expansion” might happen.

Right now, as Sandin himself admits, most of BookBeat’s 600,000 paying subscribers are in Sweden, Finland and Germany, and BookBeat’s operation is notionally available across 28 EU countries. That is to say, not all EU countries have a dedicated local-language-customised BookBeat site, but the catalogue is accessible EU-wide.

That’s in stark contrast to Storytel, which had long since expanded into the wider world. Not that that matters any more – there will be no further Storytel expansion for the foreseeable future.

As noted in past discussion, the other Nordic-based player of substance, Nextory, is very much a free agent, restrained only by its funding constraints –

BookBeat by contrast is constrained by the ambitions and funding inclinations of parent company Bonnier.

And while that makes it unlikely BookBeat will ever experiment in the wider world on the scale of Tellander-era Storytel, it does leave room for manoeuvre and, given Bonnier has deep pockets and global aspirations of its own, the possibility of a level playing field for Nextory CEO Shadi Bitar and BookBeat CEO Niclas Sandin to club one another’s brains out for the Storytel-vacated audio-streaming crown.

But beware the pretenders to the throne off-screen. Amazon’s Audible for now is still run by Amazon on the rails laid down a decade or more ago, but no-one should rule out Amazon one day deciding unlimited streaming is the way it wants to go. And as we are seeing, it is already sending out strong signals to that effect.

And then there’s Spotify, the new kid on the audiobook block that many in the industry establishment are happy to laugh at and shun. No room at the inn, guys. Sorry. And you can stuff your unlimited model where the sun doesn’t shine.

They might want to look carefully at how the music industry establishment fell about laughing when Ek first tried to convince music publishers that streaming was a good idea.

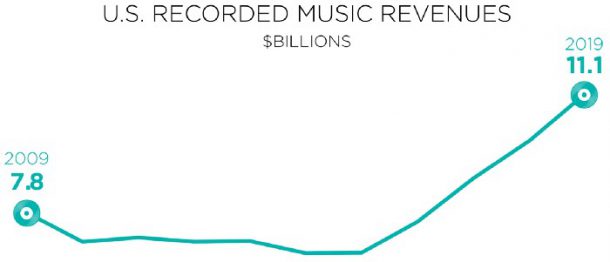

Many may still argue it’s not a good idea, but no-one can deny it’s a reality. And a reality that totally transformed the music industry, to the point where streaming revenues far, far, far exceed peak retail revenues from the pre-streaming era. Take a wild guess at which point streaming took off on this graphic:

For the background, see this post:

Spotify’s move into audiobooks is a seismic shift in the publishing landscape, but the ripples will take time to be felt

The reality is consumers love unlimited subscription and while there are winners and losers in any scenario there’s no reason bar obstinance and wilful dismissal why streaming cannot transform the book publishing industry.

Curiously the BookBeat-RBMedia deal just announced rather paves the way. Because RBMedia is about to show that mainstream English-language titles can be a lucrative revenue stream – even when streamed unlimited – in markets beyond the usual each of such titles.

And of course when it comes to potential global audio reach Spotify, with its 422 million monthly active users and its 182 million paying subscribers, makes Audible, Storytel, BookBeat, Nextory, Scribd and all the rest put together look like a sideshow.

This year we will see Spotify ramp up its audiobook sector thanks to the Findaway acquisition –

– a fine example of the ripples of the Spotify-initiated seismic shift in the audiobook market referenced above – and it looks like we’ll see Spotify straddle both subscription and a la carte offerings, although the detail remains to be seen.

That’s a potentially risky road for Ek to take Spotify down, but of course as it now owns Findaway it’s easy to experiment and, if necessary, switch track later.

To be sure there will be lots of tweaking and likely full reversals as Spotify explores and experiments in the audio market beyond music and uses its unparalleled global reach to bring the audio-text format to new audiences. But the winners, along with Spotify, will be those publishers willing to join the exploration.

And what better place to start than with the existing market-leaders in the sector – BookBeat, Nextory and the down but not out Storytel.