After all, the man has not died. These aren’t forgive-and-forget obituaries where we can’t speak ill of the dead. Markus Dohle is alive and well and has just jumped ship having been at the helm when it hit the reef.

If initial reports and the predictably meaningless exchange of departing niceties can be believed, Markus Dohle has left Penguin Random House of his own volition, with parent company Bertelsmann expressing its “regret”. And much of the industry media commentary is predictably focussing on the man and his affability rather than looking too closely at what Dohle’s departure means for the wider industry.

But given PRH is the world’s largest trade publisher by far, the departure of Dohle is about far more than just who heads a particular company, and why we need to take an objectively critical look at Dohle’s more recent time as CEO of PRH.

After all, the man has not died. These aren’t forgive-and-forget obituaries where we can’t speak ill of the dead. Markus Dohle is alive and well and has just jumped ship having been at the helm when it hit the reef.

Dohle of course has led the company for fifteen years, and no-one can deny the overall performance has been impressive, with PRH an industry powerhouse like no other.

But we need to ask how much of that was down to a deep understanding of, and ability to respond to, the needs of the industry and how much just complacent coasting that comes with being the biggest fish in the pond, devouring rivals rather than actually growing the pond.

Dohle entered the latest acquisition round seemingly confident he could win, knowing full well the anti-trust issues this proposal would trigger, and knowing full well the costs of failure for parent company Bertelsmann.

Dohle is no lightweight in the business of publishing, but as the Court case unfurled it became increasingly obvious the PRH legal team – and Dohle himself – were woefully ill-prepared, over-confident and out of touch with consumer and author attitudes towards the company.

Dohle was being forced to reveal in public how much PRH paid its top authors, how much market share it had lost, and worst of all how little real business acumen was involved in running the biggest trade publisher on the planet, suggesting luck and instinct were more important than being the biggest publisher in town.

All of which begged the question, what did Dohle actually contribute to the success of PRH? Had Markus Dohle in fact passed his expiry date?

It’s a telling point that a business of Bertelsmann’s size chose not to make Dohle an offer he couldn’t refuse to entice him stay on.

But then, Dohle had just cost the parent company a $200 million “break-up fee” and untold legal costs on top of a public humiliation having to admit that since the Penguin acquisition way back in 2013 the newly formed PRH had actually lost market share.

And that’s just the market share Dohle is willing to admit to. There is another huge chunk of market share being gobbled up by self-published authors that Dohle avoids ever mentioning.

Worse still, PRH was desperate to buy Simon & Schuster not to expand to new heights and boldly go where no publisher had gone before, but just to recoup some of that lost ground.

The only consolation for Dohle was that the Court decision effectively ruled out Simon & Schuster being acquired by another Big Five publisher. At a cost of $200 million (already paid over) plus legal fees.

But the Court ruling and break-up fee are just part of a wider picture showing the PRH CEO to have become increasingly complacent and blinkered as to the realities of the evolving publishing industry.

Much is being made of Dohle’s affability, and of course he was head of the company as it rode to record profits on the tail of the Covid-driven bookselling bonanza, but let’s be absolutely clear that was a rising tide that raised all boats, and had nothing to do with Dohle’s leadership.

PRH UK was among the first publishers to furlough its staff as Covid-19 arrived, fearing the collapse of the publishing industry.

That lockdown boosted reading to new heights was as much a surprise to Dohle as to everyone else, and the record profits that came in 2021 had very little to do with Dohle’s leadership. He happened to be in the right place at the right time.

In March 2021 Dohle talked of the industry reaching new heights but his nonsensical talk of “digital fatigue” echoed a long-term commitment to side-lining digital to keep print at the fore.

I made a bet on print, when all the experts were saying printed books would be gone. I invested a lot into the print format. We don’t care in which format our readers want to read. We want to reach as many readers as possible, so it’s not an ‘either-or.’

That’s rich coming from the man who pulled all PRH titles from all-you-can-eat subscription platforms.

But then, Dohle has long had a problem with subscription streaming, and especially if they happened to be based in Sweden.

Let’s first hear from Dohle at Frankfurt in 2017.

Sales of the most popular ebooks by traditional publishers have declined in the last three years in the major Anglo-American markets.

Curiously no mention of traditional publishers hiking ebook prices so they compared unfavourably with print.

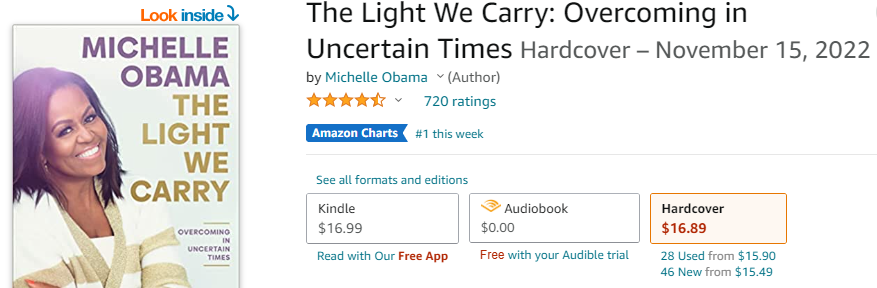

Yet fast forward 2022 and PRH is still doing exactly that, as witness this PRH-published tome on sale in hardcover for less than the ebook.

Dohle of course has repeatedly told us traditionally published ebook sales have stabilised at 20%, as if there is some consumer glass ceiling out there. And of course such glass ceilings do exist. They are artificial constructions of businesses manipulating the market as we clearly see in the above example. Dohle’s 20% ebook market is as artificial as a plastic Christmas tree. As artificial as an ebook costing more than a hardcover.

But let’s fast forward to 2022 where Dohle is, po-faced, telling the Court that the Swedish subscription outfits are the biggest threat to the publishing industry.

This matters because it demonstrates just how unhinged some of Dohle’s arguments had become.

Let’s remember that Dohle was attempting to acquire Simon & Schuster for the grand sum of $2.175 billion.

Yet in a super-soft interrogation by The Bookseller’s Philip Jones in late 2021 Dohle solemnly explained:

When it comes to subscription, I am convinced that in the long run it is not good for author income, it is not good for retail.

Look at these investments this week: big bucks flowing into the United States publishing industry, Storytel and Spotify entering the scene … We will see how this unfolds, whether readers at large will adopt those kinds of models. The future will show [the verdict], ultimately the reader will decide.

Big bucks flowing into the US publishing industry?

For the record, Daniel Ek’s Spotify paid just $123 million for Findaway and Storytel paid $135 million for Audiobooks.com. That’s a total of $257 million from the Swedes. If that’s “big bucks” I can only imagine what superlative Dohle would invoke to describe the $2.175 billion his parent company in Germany was planning to spend on acquiring Simon & Schuster.

As for “The reader will decide the future of subscription”…

Do be serious, Markus. By deliberating keeping top content – all content in the case of PRH – out of the streaming services you are ensuring readers are not being given meaningful choice.

But Dohle wasn’t finished, asserting subscription streaming could close every bricks & mortar retail store in just three years – unless the Court sanctioned the PRH deal.

And just in case anyone missed Dohle’s concern about this money being Swedish, he explained without a hint of shame, that if subscription was allowed to prevail the US publishing industry would be left,

dependent on a few Silicon Valley or Swedish companies.

That of course would be totally unacceptable. Imagine if two German companies were major players in the US publishing sector. No, wait. Aren’t both PRH and Macmillan owned by German corporations?

Or is there something special about Sweden that Dohle has a problem with? Would Dohle feel so down on subscription services if they were not mostly run by Swedes?

But the real unhinged moment in all of this is Dohle simultaneously telling us “digital fatigue” is real and 80% of consumers don’t care for ebooks while also telling us digital subscription will kill the industry in three years.

No wonder Bertelsmann could muster so little sincerity in their “regret” at Dohle leaving.

Bertelsmann is a forward-looking globally ambitious company.

Yet Dohle’s last major interview, as the Court ruling news broke, was with IPA President Bodour Al Qasimi in Sharjah, at one of the world’s largest book fairs (over 2 million visitors) where Dohle paid lip-service to the Arab market while making it very plain he had no intention of pursuing the MENA publishing opportunity.

Before the event Dohle spoke of looking forward to,

spending time in Sharjah and learning more about the long-term growth possibilities in the Gulf region, from increasing readership to publishing local voices.

But when it came to nailing his colours to the mast, Dohle could only say,

I can see quite significant operations here two-generations from now.

In other words, thanks for the invite and the nice dinner, but not in my lifetime.

But let’s end this op-ed with one final example of Markus Dohle being out of tune with the industry’s needs, cocooned by the sheer size of PRH.

In the New York Times, NPD Books’ Kristen McLean, spoke of,

Unknowns at every level. There are unknowns with consumer behaviour, unknowns with what retailers are doing and unknowns at the publisher level about what to invest in right now.

All well and true, but the industry, led by Markus Dohle, handed over control to Amazon, when Dohle should have been focussed on leading the industry to make better deals with both physical and digital retailers.

Amazon knows every customer sale made, and at ebook level every page turned.

That PRH and other publishers have no such insights shows just how much of the fifteen years of Dohle’s tenure was squandered, losing market share after 2013, fighting digital instead of embracing its possibilities, and blindly supporting the print model with no attempt to modernise it or engage with print retailers to share customer insights.

Dohle conveniently leaves PRH as the industry faces real challenges. Challenges PRH and other traditional publishers are ill-equipped to deal with after years of complacency.

By leaving now Dohle can ride the crest of the last wave, claiming the glory of the 2021 profits bonanza and let his successor get caned as the publishing industry rollercoaster heads into its next dip.

Now that’s a sign of good business acumen.

insightful and brutal.. I am really enjoying your work