If Voxa can expand its markets following its current strategies of pursuing both public and corporate consumers this start-up could prove to be the star of the eastern Europe publishing scene.

Running a catalogue of audio and ebook titles in Romanian and English, the Romania-based streaming platform Voxa has a market capitalisation of EUR 6 million ($6.5 million), up from just EUR 3.9 million ($4.3 million) in November.

The 54% leap in capitalisation reflects the way Voxa CEO Mester Catalin has aggressively marketed the company within the Romanian market.

Attracting the desired EUR 1 million ($1.08 million) comes on the promise of further expansion within Romania and beyond. Voxa intends to launch in neighbouring Moldova in this current quarter (Q2) and in 2023 expand to further countries.

The decision to expand into neighbouring Moldova is unsurprising given the shared history and language, but where the third country might be remains to be seen, although Germany, Italy, Spain, Czech Republic, Bulgaria, Estonia and Hungary are known to be on the list.

Bulgaria is already home to Storytel, which dominates the market, but Hungary, Czech Republic and Estonia could offer Mester a chance to show off the Voxa potential to its fullest.

Another contender must be Serbia, where again a Romanian-speaking element would welcome the existing catalogue and Catalin could likely bring on board Serbian publishers for the Voxa platform. Likewise Ukraine, but given the current situation there we can rule that out for the foreseeable future.

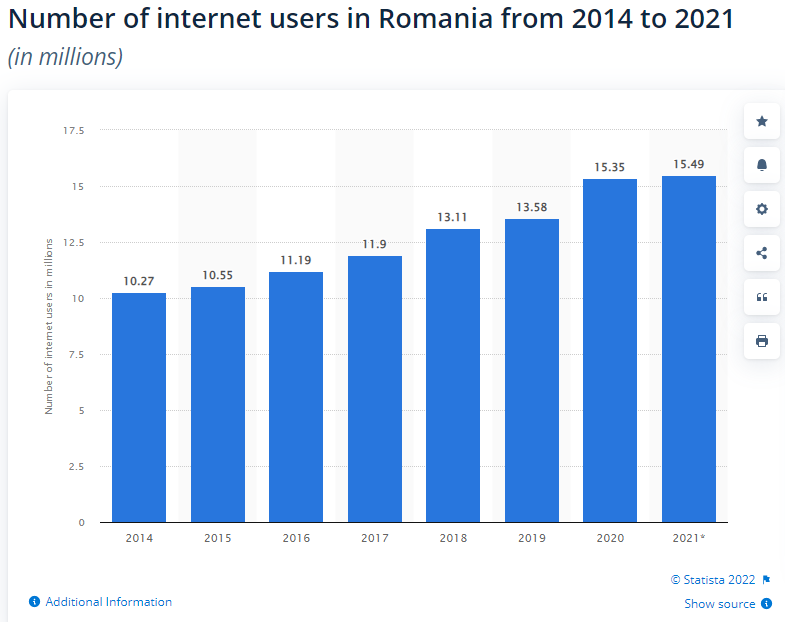

Voxa’s successful launch in Romania just six months ago has some impressive numbers to back the narrative, in mind Romania is a country of just 20 million people (helped by the fact that 15 million of those online).

Initial funding for the 2021 launch came through SeedBlink with a EUR 540,000 ($580,000) seed investment, and investors will be impressed with the way Voxa has attracted both regular consumers and the corporate sector.

Voxa only launched in November 2021, in competition with AudioTribe (originally Echo) – see TNPS pre-launch coverage here:

No word on how AudioTribe is faring with its monthly credit system, but we do know Voxa already has over 50,000 users, dipping into a catalogue of 15,000 titles, and is working with 35 partner publishers.

Alongside the promotion of the service direct to the general public, Catalin has simultaneously pursued a B2B strategy, seeking out deals with big Romanian companies to offer their workforces a value-for-money corporate benefits package.

Catalin’s target is to have 100 corporate clients on board by end 2022 accounting for 30% of Voxa revenues.

Voxa expects to have recurring monthly revenues of EUR 100,000 and to have over 150,000 subscribers by end 2022.

If it follows its current strategies of pursuing both public and corporate consumers this start-up could prove to be the star of the eastern Europe publishing scene as this decade unfolds.