And Dohle further asserts PRH is “channel agnostic” even as it has pulled all PRH titles from unlimited subscription platforms. At FutureBook Philip Jones gives Dohle a soft pass on both counts.

FutureBook this past week managed a successful hybrid in-person and digital event that once again shone a light on what might be in publishing, as well as what is, and what was.

Among the highlights, the Zoom interview with Markus Dohle, CEO of the world’s largest trade publisher, with ambitions to be even larger being challenged by the US Department of Justice.

Interviewed by The Bookseller editor Philip Jones, Dohle offered a mishmash of contradictory statement as he defended the hoped-for Simon & Schuster acquisition against DoJ objections, and for good measure nailed his colours to the mast as regards Storytel’s and Spotify’s imminent entry into the US audiobook market.

FutureBook’s Jones picked up on the US DoJ argument that PRH had previously claimed to be “an exceptional partner to Amazon” while at the same time PRH was arguing the acquisition of Simon & Schuster was intended to counter Amazon’s dominance of the market.

Dohle explained to Jones,

I have always said that we are channel agnostic. We want to serve all channels, we don’t tell our readers where to buy their books, it is their decision.

“Channel agnostic”? “We want to serve all channels, we don’t tell our readers where to buy their books”? Be serious, Markus. It was you who pulled PRH titles from countless unlimited subscription platforms almost two years ago, telling readers clearly where they can’t buy PRH books.

Sadly Jones let Dohle get away with it.

So an emboldened PRH CEO, realising this was a soft-ball interview, went on,

Look at these investments this week: big bucks flowing into the United States publishing industry, Storytel and Spotify entering the scene.

Wait. What? Let’s hear that again. This is the CEO of Penguin Random House complaining about “big bucks flowing into the United States publishing industry” from Sweden. In the case of Storytel acquiring Audiobooks.com we now know the big bucks amount to $135 million.

The price Spotify paid for Findaway is not yet public, but safe to say the combined spending on these two acquisition did not come remotely close to the $2.17 billion Bertelsmann, the Germany-based parent of PRH, is trying to pay for Simon & Schuster.

Philip Jones declined to draw attention to this glaring contradiction in Dohle’s argument. If he had, he might have quickly calculated that the Storytel acquisition “big bucks” amounts to just 6% of what Bertelsmann will pay if the Simon & Schuster deal goes through.

Likewise Jones has no will to challenge Dohle’s contradictory statements on subscription, where Dohle has long since taken a position on streaming platforms, and is not going to let inconvenient facts and limp arguments get in the way. Retail good, subscription bad is the order of the day.

Just in case there’s any doubt, Dohle spelled it out:

We have a very clear view on this: it’s not good for authors, it’s not good for retail, it’s not good at creating the future of books and long-form reading for generations to come.

And for good measure Dohle added,

We are talking to agents and authors about this and more and more people agree with us. We will see how this unfolds, whether readers at large will adopt those kinds of models. The future will show [the verdict], ultimately the reader will decide.

Except of course that the readers’ decision to adopt “those kind of models” is being manipulated by PRH and other publishers by the simple expedient of not making big-name author titles available in the streaming services, thereby forcing readers to continue patronising the à la carte retail model if they want to read those authors’ books.

Defending the Simon & Schuster acquisition plan, Dohle entwined the two topics of acquisition and streaming, explaining the benefits of the intended Simon & Schuster acquisition are chiefly to reach more readers and have more books on shelves.

We want to have books in front of readers, we want to have books available in stock, investing in the supply chain, we want to sell more of the books that we publish and we want to make them more visible and more discoverable.

That all sounds great until you juxtapose that with the reality that for almost two years PRH titles have been absent from numerous global streaming platforms, ensuring those books have not been in front of those readers, have not been “more visible” and have not been “more discoverable”.

All of which means that authors who were getting a small percentage of something from streaming channel readers and listeners before are now getting a whopping 100% of nothing from those consumers.

In the wider FutureBook debate about the Storytel and Spotify news, comparisons were as usual being drawn with music, where supposedly artists are not doing well.

But the problem here is that we are comparing apples and cauliflowers. Leaving aside how we conveniently ignore how well the video subscription industry and the news subscription industry are doing, where the only serious opposition to streaming comes from theatre owners and super-rich film stars, there is no meaningful comparison between a royalty for a three minute single or an hour long album and an eight-hour audiobook, and we only need to look at the Nordics to see unlimited subscription is exactly what – don’t tell Markus Dohle – consumers want, and that both authors and publishers are benefitting.

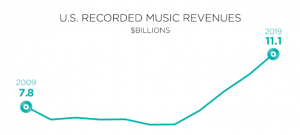

In an op-ed The Bookseller editor Philip Jones reminds us that Will Page, former chief economist at Spotify, made the point that the music industry is actually thriving, although Jones doesn’t go so far as to cite Page’s case in full, showing how subscription turned around an industry in steady decline to a situation where music streaming revenue in 2019 was bigger than total market revenue in 2017.

Take a look at the curve in this graph, where music was slowly declining despite iPods and iPads, until that fateful day when subscription became an option, which is where the curve suddenly soars.

Or to put it another way, the argument that streaming has been bad for the music industry is utter BS. Has it been bad for individual artists? Perhaps for some, but ask yourself who pays the artists. Spotify or the record label?

And don’t forget to ask yourself exactly how many authors are actually making a living from their books under the traditional publishing model?

The reality is subscription turns around stagnating and declining industries, and it’s potentially the same for book publishing. Subscription removes a lot of the expensive overheads (printing costs, warehousing, distribution, returns, etc) that eat into publisher margins meaning that they could afford to pay more royalties from the subscription revenue that comes in. And subscription removes the price friction for consumers which is why we cannot compare a la carte digital retail and digital credit-based subscription with unlimited subscription.

Subscription also opens up titles and authors to risk-averse and cash-strapped readers/listeners who simply are not going to, or cannot afford to, pay full retail price to try out an unknown author or a new genre, so stick with their safe bets.

Music and video streaming also show subscription enhances discoverability, and all the books streaming services report the same thing. Digital books subscribers read/listen more, and often than buy more à la carte as well, as was most recently confirmed by Kobo:

Our sales data from Belgium, the Netherlands and Canada suggests that having your books in Kobo Plus has a positive impact on à la carte sales. Publishers sell more à la carte, and generate increased revenue from subscription sales on top of that.

But hey, let’s not let consumer interests and author interests get in the way of protecting the status quo.

For full coverage of the FutureBook event and the subscription debate sparked by Dohle, check out The Bookseller here and here.

But a note of caution where Philip Jones solemnly tells us Storytel “remains loss-making”, with the inference streaming is not a viable business model.

It’s not clear if that is a deliberate misrepresentation by Jones or simply reflecting that The Bookseller so rarely covers Storytel news that he may be unaware of the position.

Put simply, Storytel is in 25 global markets with a target to break-even within five years for each new market it launches in. Storytel is in profit in all the markets it has been in longer than five years, and in some has become profitable in less time. It is overall unprofitable for now in the most recent markets where it is still in the investment stage.

In any case Dohle and Jones are barking at the wrong spectres when they single out Storytel and Spotify as unlimited subscription bogeymen.

Per coverage here at TNPS, Amazon-owned Audible has now rolled out unlimited subscription as an option in six of its markets, and in two of them – Italy and Spain – unlimited subscription is the only option.

As an “an exceptional partner to Amazon” it’s understandable Dohle does not want to make a fuss about Audible’s inexorable unlimited subscription roll-out, and of course Storytel and Spotify are soft targets by comparison.

PRH is a great publishing company doing great things, and Dohle has done a great job not just at the helm of PRH but as a leading voice for the industry. But let’s not for one second pretend the latest rhetoric against the entry of Spotify and Storytel into the US market is anything other than self-interest.