Publishers still on the fence about subscription – or worse, still in denial – really need to reconsider their position. The 2020s will be the decade subscription comes of age.

“Spotify’s move into audiobooks,” I wrote here back in August 2020, “is a seismic shift in the publishing landscape, but the ripples will take time to be felt.”

Since then the ripples have been gently rocking publishing boats and lapping the shore, but this month we have news of two big ripples making themselves felt.

But first, this from the aforementioned TNPS post last August.

With 138 million paying subscribers and 299 million monthly users Spotify is by far the biggest audio platform in the world (for comparison Amazon Music hit 55 million subscribers as this year began), and revenues for the last three quarters to end June 2020 hit $2.25 billion.

Can Spotify dominate the audiobook scene in the same way?No is the simple answer. But it will fundamentally change the audiobook model in the western markets before this decade is over.

Last week Spotify announced, with blatant disregard for quaint publishing anachronisms like territorial rights, that it would be rolling out its music and audio subscription service across a further 80 countries.

From that post:

With each passing day the digital subscription model engrains itself more and more in the world’s consumer psyche, and music, video and news platforms are reaping the rewards.

Book publishers, on the other hand, with noble exceptions, seem determined to be dragged screaming into the second decade of the twenty-first century when it comes to offering consumers choice.

And almost simultaneously came news that the dedicated podcast app Podimo, flush with new cash injections, would be launching in 20 Latin American countries.

For the longest time podcasting has been viewed by the publishing industry as the poor man’s audiobook, but podcasting is just one more digital genie that has no intention of going back in the bottle, and savvy publishers in the US and globally understand podcasting is a parallel opportunity to reach new audiences that can not only upsell regular products like books, ebooks and audiobooks, but can bring in serious revenues in its own right.

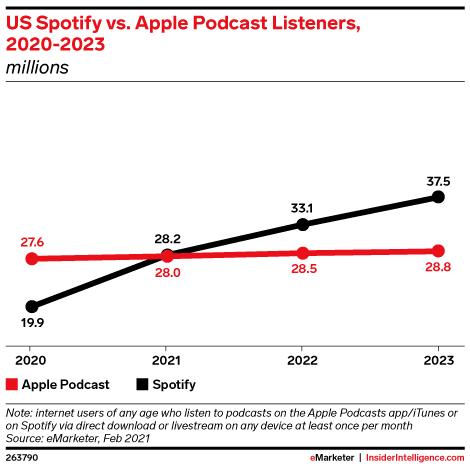

Apple has been the natural home for podcasts since way back, but opportunities to monetize podcasts are few and far between and Apple’s i-audience was always going to plateau sooner rather than later.

As this graphic from e-Marketer shows, that sooner is pretty much now. There’s still growth, but really nothing to write home about.

Enter, stage left, Spotify, pursued by bears like Podimo and any number of other pretenders to the throne.

While Apple Podcasts all but stagnates in the podcasting arena that upstart startup Spotify is expected to soar ahead over the coming years, with 41.3% growth expected this year alone.

eMarketer forecasting analyst at Insider Intelligence Peter Vahle explains,

By putting podcasts and music in one place, Spotify quickly became the convenient one-stop-shop for everything digital audio. Apple was the de facto destination for podcasts for a long time, but in recent years, it has not kept up with Spotify’s pace of investment and innovation in podcast content and technology. Spotify’s investments have empowered podcast creators and advertisers through its proprietary hosting, creation, and monetisation tools.

Overall, there will be 117.8 million overall monthly podcast listeners in 2021, a 10.1% year-over-year (YoY) increase. This year, podcast listeners will represent 53.9% of monthly digital audio listeners, surpassing 50% for the first time. We anticipate that more audio listeners will start listening to podcasts monthly, leading to a 60.9% share by 2024.

Then consider this, straight from the Spotify horse’s mouth:

As part of our ongoing commitment to building a truly borderless audio ecosystem—connecting creators, listeners, and content—Spotify is embarking on a sweeping expansion that will introduce the world’s most popular audio streaming subscription service available to more than a billion people in 80+ new markets around the world, and add 36 languages to our platform.

This expansion will help ensure that sounds and stories that once remained local can reach a global audience.

And yes, that was Spotify talking about “audio”, not just music or podcasts.

At which point let’s return to that August 2020 TNPS post for a broader perspective that encompasses audiobooks.

Publishers still on the fence about subscription – or worse, still in denial – really need to reconsider their position.

The 2020s will be the decade subscription comes of age. As consumers adapt to subscription as the new normal for content consumption so à la carte retail, and especially non-digital retail, will struggle.

By 2030 the publishing landscape will be as different from today as today is from 2010.

…

US and other Anglophone publishers have been complacent so far in handing to Amazon’s Audible the level of control they went on to regret with ebooks. But for how much longer?

Spotify’s consumer-base of proven unlimited-subscription fans is going to turn heads, for sure. Publishers know in their hearts that letting Audible have control of the audiobook market is going to backfire one day.

And they also know that the Audible model of one credit per month subscription has its downsides. Not least that the unlimited subscription model is far more attractive to consumers.

They also know that the unlimited model opens up backlist revenue opportunities like no other.

That’s not so important right now, when publishers are still catching up with audio for their frontlist titles. But the time is not that far off where mature-market publishers are going to look again at the unlimited model, grasp that revenue and profit are not the same thing and that big revenue with less profit isn’t such a great idea, and start switching allegiance. This is business, after all, and money talks.

As Spotify and others grab more “Big Pub” title share so Audible, comfortable now with its credit-subscription model, will simply introduce its own unlimited model to retain its customer-base.

It’s at that point that the ripples from the quake about to happen will finally reach shore.

Make no mistake. The seismic shift is already underway.