We simply don’t know the true scale of the impact ebooks have on the US and global book markets, either in revenue terms or in consumer engagement, but we can say with absolute certainty that the AAP numbers only paint a partial picture.

The Association of American Publishers released its March 2021 StatShot report this week and unsurprisingly the March figures are up on 2020, when of course the Covid-19 pandemic first hit the USA and lockdowns began.

The AAP StatShot covers the whole of the US publishing industry by sector, but is clear about the fact that it only counts the statistics from a selected group of publishers, leaving the question how much bigger the numbers might be if we could see the whole picture.

Unfortunately there is no way to see that whole picture in detail, as many of the uncounted participants – not least Amazon Publishing (APub), myriad small presses, and untold thousands of indie authors, do not report to the AAP.

This warps the picture in favour of print, as most APub and indie revenue derives from digital sales, but it should be kept in mind that the AAP print numbers will also miss substantial APub and indie paperback print sales POD), meaning that while the hardcover numbers will include almost all sales, the paperback numbers will be conservative, while the ebook numbers paint only a partial picture.

Just how partial is open to conjecture, but it matters a lot, not least because when industry heavyweights like Marcus Dohle of Penguin Random House asserts ebooks account for only a fraction of the publishing market, what he means is that ebooks account for only a fraction of the publishing market as measured by the AAP.

Let’s take a look at the latest AAP numbers to flesh this out.

Total revenues across all categories for March 2021 were up 40.2% as compared to March 2020, coming in at $896.1 million. Year to date revenues were up 22.3%, at $3.1 billion for the first three months of the year.

Total revenues here being across all publishing sectors including academic and specialist publishing, not just trade.

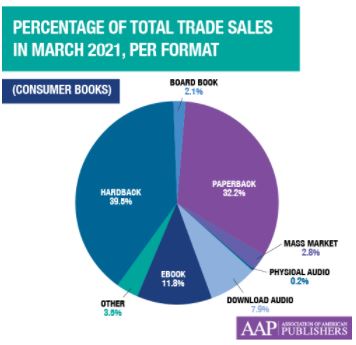

For trade (consumer) books, the AAP reported:

Trade (Consumer Books) sales were up 34.2% in March, coming in at $743.9 million, and up 24.9% year to date, with $2.1 billion in revenue.

Here’s how that trade sector broke down by format. Image courtesy of the AAP.

Explains the AAP:

In terms of physical paper format revenues during the month of March, in the Trade (Consumer Books) category, Hardback revenues were up 50.9%, coming in at $293.7 million; Paperbacks were up 27.7%, with $239.9 million in revenue; Mass Market was up 34.6% to $20.6 million; and Board Books were up 46.5%, with $15.3 million in revenue.

As ever, it’s all about revenue. So just a reminder here that revenue is how much the books sell for. Sell two books at $30 each and get $60 revenue. The profit will be a fraction of that. Print books, after the master-copy is finalised, cost money to manufacture, to warehouse and to distribute, and after that there will be deductions for returns.

Ebooks have the exact same master-copy costs, but no manufacturing, warehousing or returns, making each ebook intrinsically more profitable than its paper counterpart.

Ebooks can therefore be sold at a lower per unit price and still make more profit that the print counterpart, but in fact many mainstream publishers long since elected to keep ebook prices artificially high to protect print interests.

This had the calculated consequence of depressing demand for ebooks, something industry heavyweights like Marcus Dohle prefer not to discuss.

For digital-first operators like APub, for indie authors, for many small presses, and also for some imprints of big mainstream publishers, selling ebooks at lower cover-price is standard practice.

In revenue terms this means ebooks bring in less cash. One hundred books sold at $5 each brings in $500. One hundred books sold at $20 brings in $2,000. In revenue terms print wins hands down. But in profit terms it may be at best an equal contest, and may in fact mean less profit from print. And that is before we factor in that books at $5 are likely to significantly outsell books at $20 unless there is a big-name author or celebrity involved.

With all that in mind, let’s look at the AAP ebook numbers for March 2021 and Q1 2021:

eBook revenues were up 21.0% for the month as compared to March of 2020 for a total of $88.0 million.

eBook revenues were up 20.7% as compared to the first three months of 2020 for a total of $278.2 million.

So, $88 million worth of ebooks sold in March via mainstream publishers reporting to the AAP, while Q1 2021 saw total ebooks sales worth $278.2 million.

But what about ebook sales from APub, small presses and indie authors?

Bottom line, we don’t know these numbers in detail. APub isn’t sharing its numbers, and nor are indie authors. But we do have a strong indicator of the scale of the uncounted ebook sales thanks to Amazon’s Kindle Unlimited ebook subscription service.

Kindle Unlimited (KU hereon) is widely eschewed by mainstream publishers, while indie authors who choose to participate have to be exclusive with Amazon. KU also includes all APub ebooks.

For indie authors, KU pays out royalties each month from an after-the-fact “pot” whereby authors are paid per page read of their uploaded content.

The pot is reported each following month as a total figure, from which individual authors receive their share.

We should be absolutely clear here that the “pot” is only for participating indie authors and small presses using KDP, and is quite separate from the payout to bigger participating publishers and to APub authors.

How much does Amazon’s KU pay out each month to indie authors?

In March 2021 it was $35.4 million. Just for indie authors, remember. And this is royalties, not total revenue.

Yet here we are, looking at the March 2021 AAP ebook total revenue and the KU pot royalty payout to indie authors, and indie authors in March earned in ebook royalties the equivalent to 40% of total mainstream AAP ebook revenue.

The caveat here being the KU pot is not just US, but the bulk of it will be from the US.

For Q1 2021 the AAP tells us total ebook revenue came in at $278.2 million.

In the same period the KU ebook payout to indie authors was $104.9 million, equivalent to 38% of US ebook revenue as reported by the AAP.

This, let’s not forget, is just for Kindle Unlimited, the unlimited ebook subscription service Amazon operates in parallel but separate from it’s à la carte ebook store, the Kindle store.

Safe to say we can add million of dollars more in à la carte ebook sales on Amazon, from APub, small press and indie authors, that again are totally off the radar of the AAP numbers.

And while the volume will be smaller we can also say the same of ebook revenues from indie authors on Apple, Google Play, Nook, Kobo, Scribd, etc, that are happening off the AAP’s radar and therefore conveniently out of sight of industry heavyweights like Marcus Dohle.

As reported here earlier this month, Amazon paid out more than $1 billion in ebook royalties to indie authors through KU in just the past three years, again quite separate from its à la cart sales.

We simply don’t know the true scale of the impact ebooks have on the US and global book markets, either in revenue terms or in consumer engagement, but we can say with absolute certainty that the AAP numbers only paint a partial picture.