The bottom line is, even with the pandemic, digital books remain a (comparatively) small part of the UK book market, and will continue to be so so long as UK publishers artificially depress the digital market and eschew options like unlimited subscription.

The head of the UK’s Publishers Association puts a brave face on the latest numbers from Nielsen, which show digital heading for an all-time high as this year winds down.

Despite a significant drop in print sales, as we’d expect with the country’s “nations” (England, Scotland, Wales, Northern Ireland) in varying stages of lockdown, UK publishers have been doing surprisingly well this year, and that is in large part due to online print sales, and to sales of ebooks and audiobooks.

Per the UK’s The Guardian, summarising the latest Nielsen stats,

The pandemic has revived the fortunes of the consumer ebook. The format once touted as the future of reading has suffered six straight years of sales declines since peaking in 2014 but this year has been different, with sales home and abroad up 17% to £144m in the first half. UK publishers can now expect consumer ebooks to enjoy their best year since 2015, when sales were just under £300m.

The UK Publishers Association CEO Stephen Lotinga explained,

In a challenging year for the UK publishing industry, growth in digital has helped counterbalance print decreases. These figures really emphasise the enduring nature of books and reading – and that readers continue to embrace books in all their forms.

So let’s get this straight. With people confined to their homes, with endless time to spend on their screens on social media or playing mobile games or watching Netflix… The enduring nature of books and reading prevails, says Lotinga.

That’s great. Nothing to disagree with there. Only… Whatever happened to screen fatigue, Stephen?

Screen fatigue? That was the buzzword in the publishing industry a few years ago when the digital naysayers were eager to explain slowing ebook sales without admitting publishers had artificially warped the market against the format.

This was Stephen Lotinga in 2017, as quoted by the same The Guardian that brings us today’s story (Media Business Correspondent Mark Sweeney seems to share Lotinga’s disdain for ebooks and prefers not to bother looking at past coverage for inconsistencies).

I wouldn’t say that the ebook dream is over but people are clearly making decisions on when they want to spend time with their screens. There is generally a sense that people are now getting screen tiredness, or fatigue, from so many devices being used, watched or looked at in their week. [Printed] books provide an opportunity to step away from that.

Back then of course Lotinga was determined not to mention the fact that publishers, in order to protect print, had pushed up ebook prices to the point where mainstream ebooks as published by PA members, once the 20% UK VAT rate had been added, meant ebooks were often as or more expensive than their print counterparts. Which of course explained why indie and APub ebook sales, which remained competitively priced, did not slump.

It wasn’t just The Guardian peddling the ebooks-are-history storyline. The UK’s The Times explained in December 2019 how audiobooks would overtake ebooks in 2020.

Needless to say I took issue with that suggestion at the time:

While of course no-one could have forecast the impact of the pandemic, it’s worth keeping in mind that audiobooks were not negatively impacted by lockdown, so if ebooks sales rose this year, audiobooks should still have continued their meteoric rise and left ebooks in the dust.

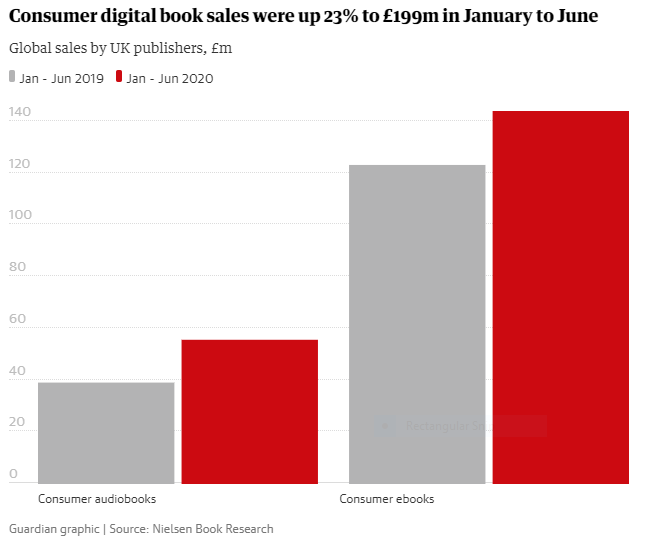

It didn’t happen, as this potent graphic from the Guardian this month shows:

In fact, UK audiobooks continue to trail ebooks by a significant margin, and there’s absolutely no reason to think audiobooks will suddenly leap ahead of ebooks as this year closes.

That’s not to say ebooks are catching up with print. How can they when mainstream publishers continue to price ebooks to protect print? Although the drop in UK VAT on ebooks has helped.

That’s another thing Lotinga is not acknowledging – that the drop of the VAT rate from 20% to 0% might be a factor in the ebook ”revival”. Price friction in the book market is something that is best not discussed, it seems, and The Guardian, with both feet firmly in the print camp when it comes to reporting on book sales, made no attempt to balance the new Nielsen numbers by pointing out there will be an untold number more ebook sales happening off Nielsen’s radar, from APub, indie authors and small presses.

But let’s stick with the Nielsen numbers, and with The Guardian’s coverage:

Sales of consumer audiobooks, which have ridden a wave of increasing popularity over the years, surged 42% to £56m in the first half – easily on track to beat the record £97m set last year. The combined £199m first-half sales of the two formats has set UK publishers up for their best-ever year for digital sales of consumer titles, well ahead of the run rate needed to hit 2019’s record total of £336m.

So even is we just count mainstream published titles and totally ignore APub and indie sales, digital is doing rather well.

But the UK print numbers are worth a look too.

Global print book sales for UK publishers fell by 17% to £1.1bn in the first half, and within this, consumer book sales dropped 12% to £653m. In the UK, sales of all forms of printed books, including other sectors such as academic titles, fell 11% to £647m. In volume terms this equates to a decline in print book sales of 55.6m globally year on year in the first half, a fall of more than 17% to 271m copies. Within that, the volume of sales of printed books in the UK dropped 24.3m during lockdown, a 14% fall to 148m.

Hardback fiction has proven to be the success story of the print pandemic, with sales up 35% to £34m for the period, as consumers looked for a premium reading experience to indulge themselves at home.

This of course another example of price friction in action. Consumers were willing to pay extra for the hard-cover experience, but faced with the choice of an ebook or a paperback at close to identical prices it seems screen fatigue was forgotten and many readers voted with their screens.

But the bottom line is, even with the pandemic, digital books remain a (comparatively) small part of the UK book market, and will continue to be so so long as UK publishers artificially depress the digital market and eschew options like unlimited subscription.

Worth bearing in mind than that, when publisher embrace digital rather than fighting it, and allow consumers to vote with their feet, the choice is clear.

Just this past week Storytel’s Jonas Tellander told of his expectation that audiobooks alone will make up half of the Sweden book market this year.

Could that happen in the UK? Easily, if it were down to consumer choice. But it won’t, so long as mainstream publishers protect their vested interest in the pre-digital status quo and continue to dictate what choice consumers have.